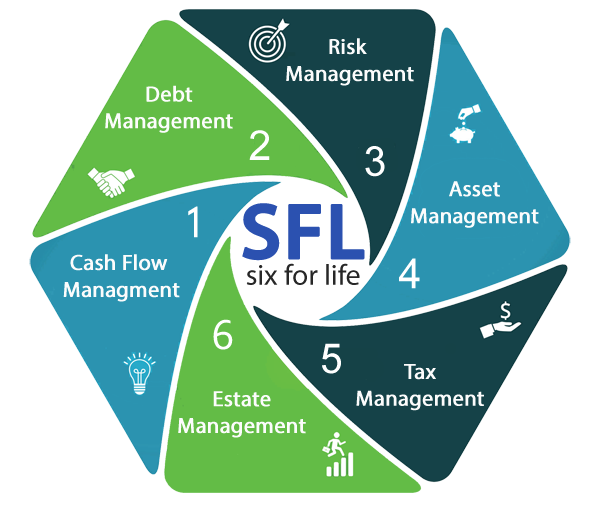

Six for Life Blueprint Program®

Financial Success with the tools right in your pocket.

We provide you with mobile friendly client portal to help you take back control of your financial destiny. See your complete financial picture from your smart phone or tablet. Anytime. Anywhere.

Hit the pause button, create the space, and take a time out for you!

The Six for Life Blueprint Program® is specifically designed for the individual or couple who are seeking coaching, education, and personal advice to their specific circumstances.

The program is designed to be completed with six to eight meetings over a twelve-week period.

The Six For Life Blueprint Program®‘s purpose is to increase your level of awareness so you can ask better questions, make better decisions, thus giving you greater control over your financial future.

The Six For Life Blueprint Program® will help you:

– Forecast and track your expenses allowing you to keep more of your

money.

– Review your current and long-term debt with the goal of reducing or

eliminating the need for credit financing.

– Maximize the value you are receiving from your insurance while seeking

to reduce your overall cost.

– Increase your savings and investments, diversify your risk, while

seeking to improve your returns.

– Review your taxable income while seeking strategies to reduce your federal

and state income taxes.

– Create an effective estate plan before it is too late.

A Blog for your Life and Money

Cash Flow Management

Tinstaafl Theory

Tinstaafl Theory. Don’t you just love the word free? It’s certainly a word that is often used in marketing phrases like: Buy one, get one free Free trial Free download Free shipping Free sample Free estimate Free gift with purchase Free demonstration Free consultation Another simple but powerful word is save. Have you ever had the experience when you are in the checkout lane at your local grocery store and after they have zapped your credit card for a couple of hundred bucks while handing you the receipt, you are informed of how much money you have saved? Really? After a quick search, I discovered a few more familiar marketing phrases that basically lead the consumer to believe they can save you money: “reduce spending on…..” “Lower the payments on…..” “Get discounts on…..” “Cut the costs of…..” “Lesson the…..” “reduce debt…..” “Trim the fat from…..” “find the best prices for…..” And if the free offer or being able to save you money won’t do the trick, then how about a few of these humdingers? No obligation Special offer Limited supply Offer expires Call right now Cancel anytime Pay nothing Before they’re gone Award-winning Money back guarantee No minimum Offer ends soon Not sold in stores Same day delivery Lowest price Guaranteed overnight delivery Act now Call anytime Same day service Based on the marketing messages, the only way it appears possible to save any money today is by acting now on that special offer for the limited supply before they’re gone. Remember, the offer ends soon and with all of the savings, we can continue to spend less and save more. Really? When I was a teenager back in the seventies and without sounding too cynical, my family had one telephone called a land line that hung on the wall, a T.V. antenna, and one 25” console T.V. that sat on the floor with three to four channels, depending on the reception. That was it! And we didn’t spend a whole lot of time or money on it, either. But today with the average cable package with internet at $165 per month and cell phones at $100 per month, the total monthly cost to watch T.V., surf the internet, and talk or text is $265 per month. This doesn’t include the amount of time and energy we spend watching these devices so they can continue to compete with pop-up ads and slick commercials that tell us what to eat, what to drink, and how to lose weight as well as pitching the benefits of prescription drugs. Really? So what if you saved $265 per month from the age of thirty-five to the age of sixty-five and earned a net after-tax rate of return of 6%? You would have over $266,000! Oh well, you only live once. I love my country, and am very grateful to have been born in the U.S.A, but when it comes to money in America, I believe in the Tinstaafl Theory. There Is No Such Thing As A Free Lunch!

Credit Debt Management

Credit Lines & Credit Bureaus

Credit Lines & Credit Bureaus. I am simply amazed by the number of credit card offers and new solicitations that I receive each month. Checks are attached and ready for me to add the payee along with my signature. A lot has been written about personal debt in America and the consequences that come along with it. While impossible to create debt without first being offered credit, the easy availability of credit is the stimulus that feeds the addiction of over spending. Many of us think of addiction in terms of substance abuse while never considering other possible forms of addiction. A synonym of the word addiction is dependence. How many of us today have become dependent on our credit lines to facilitate our emotional decisions when it comes to our purchases? I would be remiss if I didn’t speak to the ability to shop online with the use of our smart phones. Are there any limits to what can or cannot be purchased today online? And if that isn’t enough temptation, there are two cable channels that are devoted to sharing the daily gospel of shopping. In addition to credit lines, another industry has risen that is convincing Americans of the need to monitoring their credit report – credit bureaus. The three primary credit bureau companies are: Equifax – equifax.com P.O. Box 740241, Atlanta, GA 30374-0241. Ph. 1-800-685-1111 Experian – experian.com P.O. Box 2104, Allen, TX 75013-0949. Ph. 1-888-397-3742 TransUnion – transunion.com P.O. Box 1000. Chester, PA 19022. Ph. 1-800-916-8800 If you visit any of the three credit bureau websites, they are busy pitching FICO scores and the need for you to shell out $240 a year to monitor your credit reporting and scores. While you can go ahead and sign up for the twenty bucks a month based on some marketing narrative, I am not sure how that is going to help you improve your FICO score. The most effective way to improve your credit score is for you to understand how the system works and to work the system to your advantage. The people with the highest credit scores are those who have always paid as agreed, kept their existing credit balances low in relation to the credit line limits, and in general do not have any real need for credit because they have cash. I am not suggesting that you ignore your credit score and who is reporting it. Personally, I annually pull my three credit bureau reports and review the reported information for accuracy, and I can do that for a lot less than $240 bucks. One of the best places for you to begin to educate yourself on this subject is to go to the Federal Trade Commission’s website under Credit and Loans: https://www.consumer.ftc.gov/topics/credit-and-loans. This is a great resource that can be trusted because the Federal Trade Commission is responsible for the enforcement of the Fair Credit Reporting Act, a federal statute to protect you, the consumer, from those who may be gaming the system.

Risk Management

The Aging Process

While the aging process is a subject that most of us would certainly rather shy away from, it is a subject that will affect the majority of us. As you are likely already aware, life expectancy has increased substantially over the last century. However according to the CDC, the leading cause of death and disability in the United States is due to chronic diseases. As defined by the U.S. National Center for Health Statistics, a chronic disease lasts for three months or longer. Common types of chronic diseases and conditions are listed, below: ALS (Lou Gehrig’s disease) Alzheimer’s disease and/or dementias Arthritis Asthma Cancer Chronic obstructive pulmonary disease (COPD) Cystic fibrosis Diabetes Heart disease (example – congestive heart failure) Obesity Osteoporosis My work with the public for the last twenty-seven years in the areas of life and money has allowed me to experience firsthand the challenges many of us will face as we age. While chronic illnesses are emotionally difficult to endure for individuals, families and friends, it can also be very financially difficult due to the emotional uncertainty about the financial resources required to provide quality care for our loved ones. If a person becomes afflicted with a chronic illness at age sixty-five or older, the Department of Health and Human Services, Centers for Medicare & Medicaid Services, and Chronic Care Management Services are very specific in what services will be covered and/or reimbursed. The challenge facing the United States today is the aging of the baby boomers (born between 1946 and 1964). By some estimates, the boomer population is over 75 million. As this population continues to age, the increased medical demands will create a significant burden on the government entitlement programs, namely Medicare and Medicaid. Just for clarity, Medicare is the federal health insurance program for people who are age sixty-five and older or those under the age of sixty-five who have been declared disabled by the courts. In contrast, Medicaid is a jointly funded, Federal-State health insurance program for low-income and needy people, e.g. welfare. To qualify for Medicaid, an individual’s financial resources will be assessed. For services related to chronic illnesses, any private expenses are first paid by the individual with any remaining expenses possibly covered by Medicaid. This being the case, anyone with substantial financial resources will be required to cover the expenses of chronic illnesses until they fall below certain threshold levels established by specific State Medicaid requirements. For those individuals who believe they may be able to game the system by hiding or transferring assets prior to applying for Medicaid benefits, they may want to think twice as the states have adopted a look-back period. For example, the look-back period in the state of Indiana was extended to five years. Moving forward over the next twenty years, the current health care system that covers the issue of chronic illness is, by all measures, unsustainable. Due to budget constraints, the states will be forced to implement new protective measures to prevent those with financial resources from gaming the system. For anyone who has created sufficient amounts of investment capital and/or real assets, it would be wise to educate themselves on the cost of healthcare in order to be better positioned for the final stages of life.

Asset Management

The Challenge of Expectations

The Challenge of Expectations. Nothing in life has more potential to create emotional frustration than the erroneous expectation that something will occur in the future. Take the word “perfect”. Has something ever been touted to you as being “perfect”, only later to be extremely disappointed? Personally, I limit the use of the word “perfect” to those fleeting moments in life that seem to occur only in the present. The term “perfect” is often used in the context of investing. Manufactures of investment products, along with those marketing their products, will place an emphasis on historical performance. In the mind of the investor, this focus often creates expectations of being able to realize similar returns in the future. I believe historical returns have their place in comparative analysis of comparing similar type of investments in order to understand how these investments performed under similar time frames and circumstances. However, historical returns are based on the past. When it comes to the future, I have yet to be convinced that anyone has the ability to consistently and accurately predict what will occur in one, three, five, or ten years. Therefore, my conclusion is that there is not any perfect investment approach or perfect product that will consistently meet or exceed erroneous expectations. This leads me to my next point- establishing a high probability of a sustainable standard of living. Having a dual role as a professional coach and investment advisor representative, my core focus is squarely placed on the subjects of both sustainable personal change and standard of living, subjects that enhance the quality of life. To accomplish this goal, a realistic and conservative set of assumptions is required that have a high probability of achieving those set of assumptions. Let me also define sustainable standard of living as having the financial resources available to meet the demands of life, as needed. Simply put, having more money at the end of the month as opposed to more month at the end of your money. At the very core of financial sustainability, the issue is how well funded is the household. For sources of income like social security, pensions and investible assets, how reliable are they in producing the overall income needed to cash flow future expenses? This task of accurately defining and establishing a set off assumptions is critical to the goal of experiencing a life that is free from the effects of emotional uncertainty and anxiety created when we are faced with change that is often beyond our control. It is very valuable to establish a set of pragmatic assumptions in the areas of annual fixed and discretionary spending, consistent sources of income, required rate of return, inflation, and taxes as well as the time period to be covered. For those who are seeking a life that is in alignment with what they value the most, what is the value of being financially secure to you?

Tax Management

The Basics of Tax Language

The Basics of Tax Language. This certainly isn’t a subject most us, including myself, like to think about and certainly isn’t one that appears to be going away anytime soon. As wealth accumulates for future needs, the tax rates by federal and state governments will likely increase due to budgetary issues. Therefore, my goal is to share some basic tax language, concepts, and distinctions that I believe every person should know. Let’s first begin with a list of terms: Earned income versus unearned income Tax deductions and exemptions versus tax credits Social Security versus Medicare tax Long and short-term capital gains tax Marginal tax rate versus effective tax rate Tax deferred versus tax-free For 2017, federal income tax has seven progressive brackets – 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. The amount of tax you owe depends on your income level and filing status. Earned income includes wages, salary, professional fees, and commissions. In contrast, unearned income is income derived from savings accounts, certificate of deposits, and investment accounts. Because the income classifications are taxed at different rates, it is important to understand the distinction between the two. With a progressive tax system, reducing your taxable income is important. This can be accomplished through tax deductions and exemptions. A tax deduction is a reduction in tax obligation that is accomplished by lowering the taxable income. Common tax deductions include charitable contributions, 401k contributions, mortgage interest, and student loan interest. In contrast, a tax credit is a monetary amount that directly reduces the actual taxes owed to the government. On earned income up to $127,200 in 2017, the Social Security tax rate is 6.2% for employees and 12.4% for the self-employed. In addition, the Medicare tax rate on earned income is 1.45% for employees and 2.9% for the self-employed. High-income earners also pay an additional 0.9% in Medicare taxes on earning above certain amounts. A capital gain is the profit that is realized when investments (like property, stocks, and bonds) are sold. A short-term capital gain is any investment owned for exactly one year or less. Whereas a long-term capital gain is any investment held for more than a year. How long the investment is held influences the tax treatment of the capital gain. Short-term capital gains are taxed at ordinary income tax rates while long-term capital gains are taxed at a lower rate. Because of our progressive tax system, a basic understanding between taxable income and the seven tax brackets is important. Specifically, the taxable income levels that shifts the tax rate from 10% to 15%, from 15% to 25%, etc. This higher tax bracket is referred to as the marginal tax rate and is the top rate that you are being taxed. In contrast, the effective tax rate is calculated by dividing your income taxes paid into your gross income. And lastly, a discussion about tax deferred versus tax-free Is warranted. Tax deferred refers to accounts that have favorable tax treatment. This allows income and capital gain taxes to be deferred and not paid until a future point in time. In contrast, tax-free refers to accounts that are free indefinitely from taxation of income and capital gains.

Estate Management

Estate Planning Basics

Estate Planning Basics Let’s begin with the definition of the term estate. The Merriam-Webster defines the term estate as “the aggregate of property or liabilities of all kinds that a person leaves for disposal at his death”. Simply put an estate is everything you own and/or owe. Thus, effective estate planning is the transfer of ownership of assets of the decedent to the beneficiaries. Before I begin to speak on the issue of the transfer of assets at death it is important that you first understand the distinction between real property, tangible personal property, and investible assets and how those assets are titled. Real property consists of assets such as land, homes, businesses, and automobiles or any asset that can be legally titled thus entitle the owner with property rights. Tangible personal property consists of all the stull we own that cannot be legally titled. Examples would include jewelry, guns, equipment, televisions, furniture, and any other item that could be found in any average household. Lastly, investible assets consist of bank accounts, certificates of deposits, mutual funds, stocks, bonds, cash value insurance products. Now on to the subject of titling assets, which for me is the single most important concept of the entire subject of estate planning. Whenever we purchase real property, open a checking account, brokerage account is the decision of how to title the asset. Assets can be titled in a number of various ways for example they can be titled as: Individually Joint tenants Joint tenants with rights of survivorship Tenants in common Traditional IRA Rollover IRA 401K 403B Roth IRA 529 Plan Uniform Gifts to Minors Act Revocable Trust Irrevocable Trust Clearly it is beyond the scope of this writing for me to speak to the definitions and distinctions of the various ways assets can be titled, but what I hope to accomplish is to bring to your attention that there are several ways that assets can be titled. So why is this important? Because when a person who individually owns an asset dies, who owns the asset? My question isn’t who is supposed to get the asset, but rather at the moment of death who owns the asset? The answer is simply no one. And if no one owns the assets then an estate must be created and filed with the Probate court. The Probate court is the legal process to provide the administration of the decedents estate by providing the following services including the services of legal counsel “a Lawyer”. The Probate legal process will look something like this: Proving the validity of a will, provided there is one, Choosing an estate administrator, executor, or representative, Totaling all assets both in and out of the estate, Paying all applicable federal, and state income, inheritance, estate taxes, and other debts, Identifying all heirs and other relatives Distributing any remaining assets to the heirs as described in the will or intestacy statues. The probate process is open to the public for anyone who may have an interest in the decedents estate, it can be very lengthy, and expensive. Often, I get asked the question “what if I have a Last Will and Testament doesn’t this prevent my estate from having to go through the probate process”, and the answer is no. The reason being is the Last Will and Testament doesn’t solve the issue of no one owning the asset. The Last Will and Testament is nothing more than a legal document that states who is supposed to get your stuff. If you die without a Last Will & Testament, then you have died “intestate” and the state intestacy laws will determine who will eventually get your stuff. If the beneficiaries of the estate begin to have differences of how the estate should be divided, these disagreements will tend to take up more time and as the saying goes “time is money” thus driving up the legal fees and reducing what is left for the beneficiaries. Even worse these disagreements can destroy friend and family relationships for generations. Now if all you own is a house, some used furniture, and a couple of cars and are not really concerned what happens after you are gone then the Last Will and Testament should serve your interest just fine. As I have often heard “just let them fight over it”. So, what can be done to transfer your assets to those you care about while avoiding the probate process? Simple answer jointly title your assets and/or beneficiary designations. The most effective way for real property and non-retirement investible assets such as bank or brokerage accounts is to title these assets in one of three ways depending on the type of relationship. Joint Tenants, Tenants in Common, and/or Joint Tenants with rights of survivorship. Additionally, depending on the state you live in is the beneficiary option of (TOD) transfer on death. The TOD option generally allows the ownership of the assets to be transferred to the designated beneficiary upon your death. When it comes to retirement accounts or insurance policies these accounts will transfer by beneficiary designation. Typically, there will be the primary beneficiary or beneficiaries and contingent beneficiary or beneficiaries. Always be certain that your current beneficiary elections are up to date with your distribution desires. Finally, and possibly the most effective estate management tool is the implementation of a Revocable Living Trust. If you would like to understand more about the topic of the Revocable Living Trust, please see my article Estate Planning The Revocable Living Trust. Lastly, I want to disclose that I am not a licensed Attorney at Law and you should seek out a competent estate planning attorney when and if you are ready to implement or review your current estate plan. This document is for educational purposes only and is not my intent to provide legal advice.