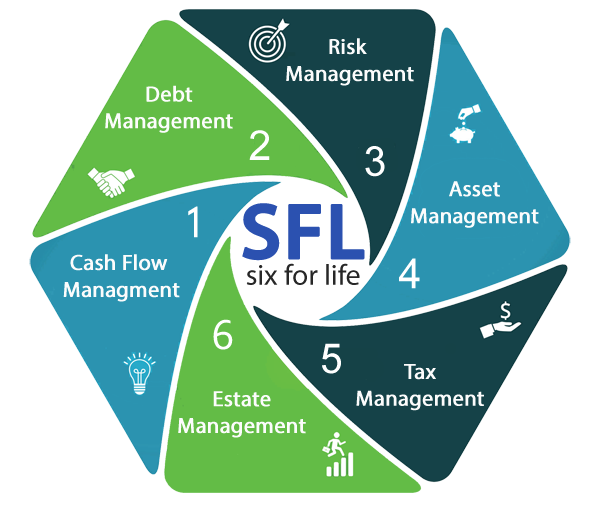

The Six for Life Blueprint Program® consists of six distinct financial areas that cover cash flow, credit and debt, risk, asset, tax, and estate management. The program is designed to be completed with six to eight meetings over a twelve-week period.

Take some time for yourself by scheduling a free thirty-minute coaching call with SFL® Success Coach, Blogger, and SFL® Personal Manager Jim Kemp.

Take some time for yourself by scheduling a free thirty-minute coaching call with SFL® Success Coach, Blogger, and SFL® Personal Manager Jim Kemp.